Ethereum 2.0, frequently called ETH2 or “Serenity,” embodies a series of upgrades designed to improve the scalability, performance, and sustainability of the Ethereum blockchain and its ecosystem. These enhancements are expected to increase transaction speeds and reduce network congestion. The implementation of these improvements is occurring in phases.

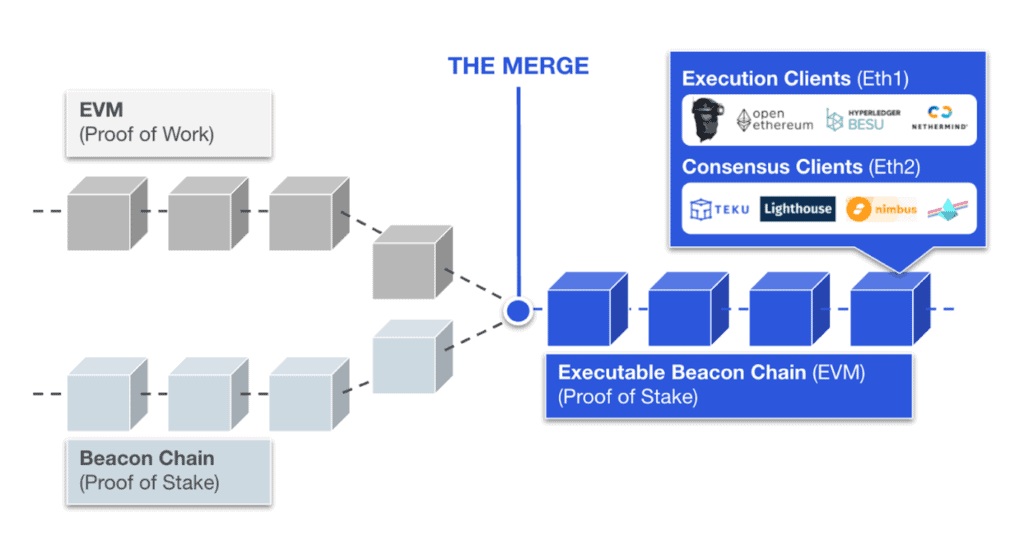

The first of the upgrades, called Serenity Phase 0, went live in a trial state on December 1, 2020. In this phase, the foundation for Ethereum’s Proof-of-Stake (PoS) blockchain was laid down. In addition, the Beacon Chain, the PoS consensus mechanism, and validator nodes were implemented into Ethereum’s ecosystem and are operating in parallel to the legacy Ethereum blockchain.

In the next phase, called “the Merge”, the Beacon Chain PoS system will merge with the Ethereum mainnet, marking the end of Ethereum’s Proof-of-Work (PoW) system. This is one of the hottest topics in the crypto world right now. This transition from PoW to PoS has been a long time coming, having been delayed numerous times over the past year. Many crypto fans expect this shift to take place in May or June 2022.

What Will Happen When Ethereum Goes PoS?

Mining cryptocurrencies like Ethereum is not as profitable as it was years ago due to the increasingly high costs and rising difficulty. Ethereum’s “difficulty bomb” that comes with the transition from PoW to PoS will cause an exponential increase in the difficulty of the PoW mining, eventually making mining impossible. Furthermore, the difficulty bomb discourages miners from staying with the PoW mechanism by increasing the amount of time and computational resources needed for transaction verification, thereby making Ethereum mining unprofitable and disincentivizing. What does this mean for miners?

As of the time of writing, the Ethereum network hashrate clocks in at over 1000 TH/s. When the PoS upgrade is finalized on the blockchain, this hashrate will be distributed to other algorithms and blockchains that still support mining.

In this article, I will focus on the alternative cryptos that miners can mine using consumer hardware after Ethereum’s shift to PoS. Keep reading to learn more about what you should mine once Ethereum goes PoS!

Here is a comprehensive list of GPUs and Hasrates.

Top 6 Cryptos to Mine When Ethereum Goes PoS

Once Ethereum goes PoS, those looking to stop mining will have to dump or sell their hardware and start staking, while those looking to continue mining will have to transition to other coins. The bottom line is that the network hashrate will go to other PoW coins or tokens that miners can mine for a profit. The best coins to mine would be those that can be mined profitably using consumer hardware like graphics cards. Here are some examples of the alternate coins to mine after Ethereum goes PoS:

Flux (FLUX)

Flux is one of the top cryptos to mine once Ethereum goes PoS. Flux is a Zcash (ZEC) fork that seeks to bring forth a new generation of scalable decentralized cloud infrastructure for Web 3.0 and decentralized applications (DApps). For this purpose, Flux offers a set of blockchain tools and a decentralized development environment similar to Amazon Web Services (AWS). Developers can easily utilize these tools to create blockchain-based products and services with real-world use cases, which will help hasten the adoption of blockchain solutions.

The native asset of Flux is FLUX, an ERC-20 standard token. The supply of FLUX is capped at 440 million. FLUX is a fair-mined, PoW cryptocurrency that powers the ecosystem. It is also a GPU mineable crypto and is used by the platform to incentivize Flux Node operators and governance participants. For every transaction, 50% of the fee is distributed to the node operators and the other 50% to miners.

Flux utilizes a custom PoW hashing algorithm called FluxHash. The hashing algorithm is based on Equihash algorithms from Zcash and Zhash. In addition, FluxHash is ASIC-resistant, making FLUX mining decentralized and attractive to miners with consumer hardware.

Details about Flux:

| Project | Flux |

| Crypto | FLUX |

| Mining Protocol | FluxHash |

| Consensus Protocol | PoW |

| Halving | 2.5 years |

| Current Block Reward | 75 FLUX |

| Block Time | 2 minutes |

| Max Supply | 440,000,000 FLUX |

| Reward Ratio | 50% to PoW miners 50% to nodes |

| Current DAG Size | ~2.9 GB (non-expanding) |

Ethereum Classic (ETC)

Ethereum’s most popular fork, Ethereum Classic (ETC), is another crypto to look after Ethereum’s transition to PoS. Ethereum Classic emerged after part of the community refused to restore the stolen funds from the infamous Ethereum decentralized autonomous organization (DAO) hack in 2016. This Ethereum fork will remain as PoW even after Ethereum transitions to PoS as the Ethereum Classic network participants came to a consensus to defuse the difficulty bomb, thereby discarding a PoS future.

Ethereum Classic’s hashing algorithm is a modified version of the Ethash mining algorithm called Etchash. The epoch duration was increased from 30,000 to 60,000 to reduce the DAG size and prevent Ethash miners from processing the new algorithm and mining ETC, Ethereum Classic’s native asset and another GPU-mineable coin. Ethereum Classic’s DAG size is under 3GB as of the time of writing, meaning that ETC can be mined using graphics cards with a minimum of 3GB of memory.

Details about Ethereum Classic:

| Project | Ethereum Classic |

| Crypto | ETC |

| Mining Protocol | Etchash |

| Consensus Protocol | PoW |

| Halving | – |

| Current Block Reward | 3.2 ETC (Block reward reduction of 20% per 5,000,000 blocks) |

| Block Time | 13 seconds |

| Max Supply | 210,700,000 ETC |

| Reward Ratio | – |

| Current DAG Size | ~2.9 GB |

Ergo (ERG)

Ergo is a Cardano-based blockchain project that utilizes the PoW consensus protocol from Bitcoin to secure the network and incorporates smart contract functionality from Ethereum to offer decentralized finance (DeFi) products and services. Similar to Cardano, Ergo follows a peer-reviewed research-based approach to developing the network. As a result, there will be fewer code vulnerabilities, but updates to the network can be slow.

ERG is the native asset of the Ergo blockchain and is another GPU-mineable coin. The supply of ERG is capped at 100 million. Ergo did not have an Initial Coin Offering (ICO), pre-mine, or any venture capitalist (VC) funding. For each block, 90% of the reward is distributed to miners, while 10% is allocated to the Ergo Treasury.

Ergo’s hashing algorithm is a modified version of Bitcoin’s SHA-256 mining algorithm called Autolykos. The team behind Ergo modified Bitcoin’s mining protocol by making Autolykos highly ASIC-resistant, resulting in higher energy efficiency. In addition, the ERG DAG size is under 2.5GB as of the time of writing, so miners can also mine ERG using consumer hardware with under 3GB of memory.

Details about Ergo:

| Project | Ergo |

| Crypto | ERG |

| Mining Protocol | Autolykos v2 |

| Consensus Protocol | PoW |

| Halving | – |

| Block Reward | 75 ERG at launch (Block reward falls to 0 after 8 years) |

| Block Time | 1 minute 40 seconds |

| Max Supply | 100,000,000 ERG |

| Reward Ratio | 90% to miners 10% to the Ergo Treasury |

| Current DAG Size | ~2.30 GB |

Firo (FIRO)

Firo, formerly known as Zcoin, is a privacy-based cryptocurrency aiming to protect the anonymity of users’ network transactions. Firo’s native asset of the same name, FIRO, is also a PoW coin designed to be mined with GPUs. The maximum supply of FIRO is 21.4 million.

With its Lelantus protocol, Firo allows users to burn their coins and destroy them to wipe, resulting in permanently unrecoverable coins. The users can later redeem the burned coins for fresh coins with no previous transaction history, making the tracking of transactions across wallets very difficult. In an upgrade, the new Lelantus Spark protocol renders the redemption process unnecessary, wherein users can directly exchange the two types of coins without exposing the output amount instead.

The hashing algorithm of this privacy-based cryptocurrency is called FiroPoW. Firo’s mining algorithm is a modified version of the ProgPoW mining algorithm, an improved version of the Ethash protocol designed to resist ASIC miners and centralized mining. Firo’s modifications allow FiroPoW to use all parts of a GPU as well as provide enhanced ASIC resistance. However, Firo’s DAG size is larger than the other cryptocurrencies mentioned above, sitting at over 4GB of memory. As a result, miners will require higher-end GPUs with more memory to mine FIRO.

Details about Firo:

| Project | Firo |

| Crypto | FIRO |

| Mining Protocol | FiroPoW |

| Consensus Protocol | PoW |

| Halving | 4 years |

| Current Block Reward | 12.5 FIRO |

| Block Time | 5 minutes |

| Max Supply | 21,400,000 FIRO |

| Reward Ratio | 50% to miners 35% to masternodes 15% to the development fund |

| Current DAG Size | ~4.3 GB |

Ravencoin (RVN)

Ravencoin is another crypto project miners should keep an eye on after Ethereum’s transition to PoS. RVN is Ravencoin’s native asset. The maximum supply of RVN is 21 billion.

Ravencoin is built on a Bitcoin fork and was launched without any ICOs, pre-mine or masternodes. Ravencoin’s blockchain handles the efficient creation and transfer of assets among parties, allowing users to create any personalized asset. On Ravencoin’s blockchain, users can issue a token representing any real-world assets such as securities, gold, shares of stock, and other asset types.

To mine RVN, you will need a GPU. You can also mine RVN with a CPU, but realistically, you will be unable to turn a profit. Ravencoin utilizes the KAWPOW mining algorithm, a modified version of Bitcoin’s PoW protocol. Ravencoin still uses PoW to secure the system but modified the hashing algorithm to allow more decentralized mining. The modifications provide resistance to ASIC and specialized hardware mining, allowing users to mine RVN with consumer hardware.

Ravencoin went through a halving in January 2022 without much upward price movement. As of the time of writing, RVN’s price trend is following the overall cryptocurrency market, which is currently in a downward trend. Hence, it may not be as profitable to mine RVN now compared to 2021. However, if RVN’s price begins moving upwards again, it may compensate for the reduced block rewards and the increased hashrate from Ethereum as well as make mining RVN profitable once again.

Details about Ravencoin:

| Project | Ravencoin |

| Crypto | RVN |

| Mining Protocol | KAWPOW |

| Consensus Protocol | PoW |

| Halving | 4 years |

| Current Block Reward | 2,500 RVN |

| Block Time | ~1 minute |

| Max Supply | 21,000,000,000 RVN |

| Reward Ratio | – |

| Current DAG Size | ~3.3 GB |

Conflux (CFX)

Conflux is a smart contract platform like Ethereum and offers various DeFi applications and DApps. It is a public blockchain founded by top minds from Tsinghua University and the University of Toronto, bridging the gap between Asian and Western communities and communities. Conflux features a PoW blockchain and the novel Tree-Graph consensus algorithm that enhances the transaction processing speed, thereby improving its scaling capabilities.

Conflux’s native asset is called CFX, which plays a similar role as ETH in the Ethereum ecosystem. With CFX, users can pay transaction fees, earn staking rewards, participate in network governance, and more. For the miners securing the network, Conflux also incentivises them with CFX.

Conflux utilizes the Octopus mining algorithm, which is another ASIC-resistant and memory-intensive algorithm. There is not much information about Conflux’s current DAG size, but f2pool claims that you will need GPUs with more than 4GB of memory to mine CFX. Hence, you may need shell out some cash for a higher-end GPU with more memory to mine CFX profitably, which may not be easy due to the limited GPU availability.

Details about Conflux:

| Project | Conflux |

| Crypto | CFX |

| Mining Protocol | Octopus |

| Consensus Protocol | PoW |

| Halving | 4 years (There will be a governance vote to decide the course of action for the halving) |

| Current Block Reward | 2 CFX (Block reward decreases over epochs) |

| Block Time | 0.5 seconds |

| Max Supply | Uncapped |

| Reward Ratio | – |

| Current DAG Size | >4GB |

Conclusion

That’s all for the top cryptocurrencies to mine once Ethereum shifts to PoS. This is, by all means, not the complete list of cryptocurrencies that you should mine after Ethereum 2.0. There may be other no-name projects that may emerge as the most profitable coins in the future.

In reality, it is difficult to predict what will actually happen when Ethereum moves from PoW to a PoS system. Many of the existing mining hardware, including ASIC miners or GPUs, will either be dumped or repurposed to mine other coins. In addition, the distribution of the huge 1000 TH/s hashrate to other cryptocurrencies will potentially decimate some projects, possibly even making many of them unprofitable due to the sudden increase in mining difficulty.

No matter what, no coin will have the same dominance that Ethereum currently has, and after Ethereum 2.0, there may be different coins each day with higher profitability compared to other coins. Hence, it may be important to choose mining hardware or GPUs that can mine multiple different algorithms so that you switch to a different coin depending on the profitability and maximize your day-to-day earnings. For more information about what GPUs to use, please check out the list of the best GPUs for mining in 2022!

Links to helpful videos: